Inflation in the United States has shown signs of easing, with the consumer price index (CPI) for June falling by 0.1%, bringing the annual rate down to 3.0%, according to the Bureau of Labor Statistics. This marks a significant improvement from the peak of 9.1% in June 2022. The data has exceeded analysts' expectations, who had predicted a 0.1% increase for the month and an annual rate of 3.1%. The drop in gasoline prices by 3.8% has been a major contributor to this positive trend.

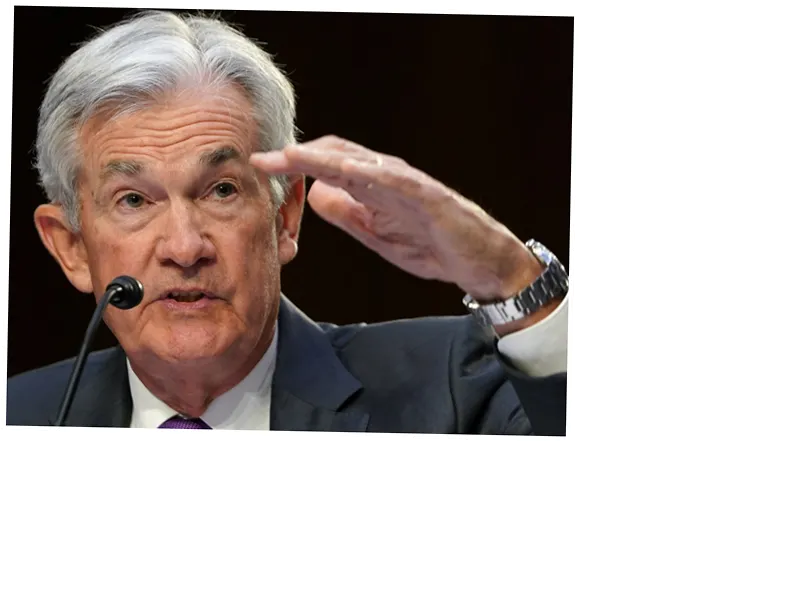

Federal Reserve Chair Jerome Powell has expressed cautious optimism, indicating that the central bank may consider lowering interest rates for the first time in four and a half years, potentially as early as September. Powell emphasized that the most recent inflation data has shown some modest gains, which could reinforce the Fed's confidence that inflation is moving steadily toward its 2% target. However, he also highlighted the need for more positive data before making any definitive changes to monetary policy.

Despite the positive CPI data, the core CPI, which excludes volatile food and energy prices, rose by 0.1% month-on-month and 3.3% year-on-year. This suggests that the battle against inflation is not yet over. The Federal Reserve's preferred measure of inflation, the PCE index, stood at 2.6% in May, closer to the 2% target, and its June data will be released in a few weeks.

The labor market has shown signs of cooling, with the unemployment rate rising to 4.1%, its highest point since February 2018, excluding the COVID-19 spike. This has raised concerns about a potential recession, although experts believe it is not inevitable. Powell has acknowledged the risk of weakening economic activity and employment if rates are cut too late or too little.

The Federal Reserve's aggressive interest rate hikes, the most significant since the 1980s, have been instrumental in addressing the highest inflation rates seen in decades. The federal funds rate currently sits around 5.5%, the highest level since before the 2008 financial crisis. While higher rates have successfully curbed inflation from its peak, the rate has remained stubbornly above the Fed's 2% target for over a year.

Economists remain divided on the path forward. Some, like those at Bank of America, foresee a 'golden path' that leaves the economy in good shape. Others, like Pantheon Macroeconomics' Ian Shepherdson, argue that the Fed has waited too long to cut rates and may need to act quickly to prevent a significant slowdown. The economic growth cycle poses challenges for President Joe Biden's re-election bid, as rising unemployment and the lingering impact of inflation could influence voters' decisions.