The Federal Reserve Cuts Interest Rates: A New Era Begins

In a landmark decision, the Federal Reserve has cut interest rates by half a point, marking its first reduction since 2020. This move brings the cost of borrowing down to a range of 4.75% to 5%, aiming to prevent the gradual cooling of the labor market from escalating into a full-blown recession. The Fed's decision reflects its commitment to achieving a soft landing for the economy amidst ongoing uncertainties.

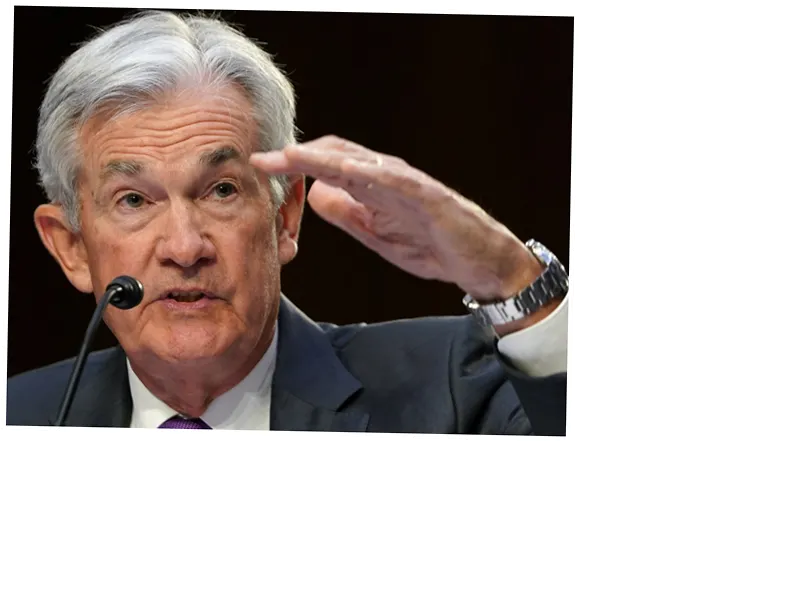

Chairman Jerome Powell expressed confidence in the economy's resilience, projecting solid GDP growth at 2% and an unemployment rate of 4.4% by the end of the year. Inflation is expected to stabilize at 2.1% in 2025. “Upside risks to inflation have receded,” Powell stated, emphasizing the effectiveness of the Fed's patient approach over the past year. The central bank reiterated its commitment to maximum employment and maintaining inflation at 2%, as outlined in its mandate.

Despite the positive outlook, the decision to cut rates was not unanimous. Governor Michelle Bowman favored a more conservative quarter-point reduction. The Fed plans to consider further rate cuts in subsequent meetings, potentially lowering rates by another half-point by the end of the year, with 25 basis points expected at each remaining meeting for 2024.

The Fed's shift to monetary easing comes after a series of 11 rate hikes since early 2022, aimed at curbing inflation. This new era of lower rates is expected to ease the financial burden on Americans grappling with high mortgage and credit card costs, while also stimulating investment growth. However, this timing raises questions, as it occurs just two months before the American elections, leading to criticism from both sides of the political spectrum. Senator Elizabeth Warren criticized the Fed for not acting sooner, calling for more significant rate cuts.

As the Fed navigates these changes, it faces a unique economic landscape. Historically, only two out of the last six monetary easing cycles since 1989 have successfully avoided a recession. Observers are hopeful that Powell can replicate the success of the 1995 soft landing, a goal that the stock and bond markets appear to anticipate positively.

Wall Street Reacts Positively to Fed's Decision

Following the Fed's announcement, Wall Street responded favorably, with the Dow Jones gaining 0.25% to reach 41,712.60 points, the Nasdaq rising 0.61% to 17,736.85 points, and the S&P 500 increasing by 0.28% to 5,650.34 points. Additionally, gold prices surged by 0.8%, reaching a record high of $2,590.13. This positive reaction underscores investor confidence in the Fed's ability to steer the economy towards recovery and stability.