Oil prices have surged amid escalating tensions between Israel and Hezbollah in Lebanon, raising concerns about a potential full-scale war. Despite a sudden increase in US oil inventories, which typically signals a demand slowdown, Brent crude futures rose by 0.5% to $85.65 per barrel, and US West Texas Intermediate crude futures increased by 0.47% to $81.28 per barrel.

The US Energy Information Administration reported a rise in the country's crude oil inventories by 3.6 million barrels last week, contrary to analysts' expectations of a decline. Gasoline stocks also increased by 2.7 million barrels, further surprising analysts who had anticipated a decrease.

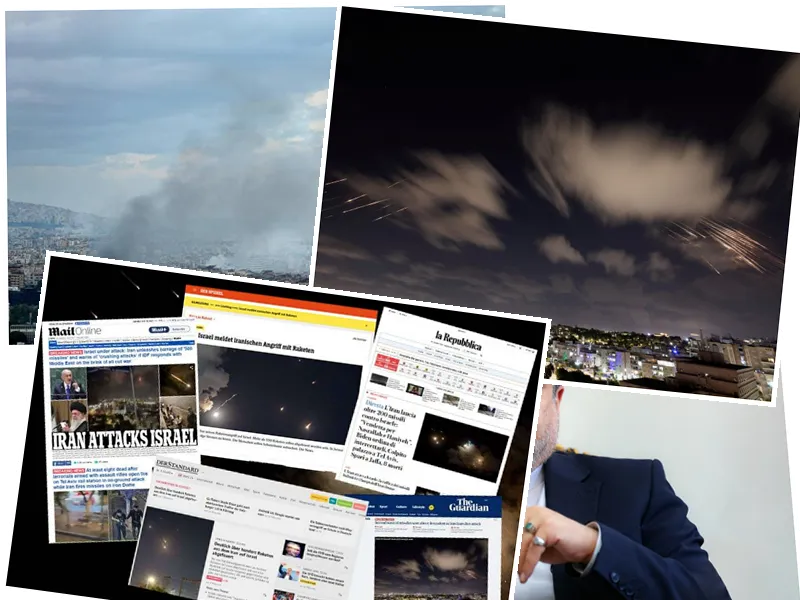

The possibility of a broader conflict involving Israel and Hezbollah has kept oil prices elevated. This potential conflict could disrupt regional stability, attract other regional powers such as Iran, and lead to significant disruptions in supply chains and trade.

Gold prices have stabilized after hitting a two-week low, with investors closely watching US inflation data. Gold rose by 0.67% to $2,313.69 per ounce. The dollar's strength, near its highest level in eight weeks, has made gold more expensive for holders of other currencies, impacting its price.

UN Secretary-General Antonio Guterres has warned of the catastrophic consequences of a war between Israel and Hezbollah, emphasizing the potential for widespread disruption, including a new wave of refugees. This scenario is particularly concerning for Europe, which is already grappling with the aftermath of the war in Ukraine and political uncertainties.

The US is also wary of another conflict, given its involvement in multiple global hotspots. Senior US officials have pledged support for Israel but acknowledge the risks to American forces and the potential impact on broader US strategic interests, including relations with Saudi Arabia and efforts to counter Chinese influence in the Middle East.

- The increase in US oil inventories has added to existing market volatility, but geopolitical risks in the Middle East are currently overshadowing these factors. Analysts are closely monitoring the situation, as any escalation could lead to further price spikes.

- Gold's role as a hedge against inflation remains under scrutiny, especially with the Federal Reserve's interest rate policies influencing investor behavior. High interest rates increase the opportunity cost of holding non-yielding assets like gold.

- Europe's political landscape is in flux, with recent elections and upcoming votes adding to the uncertainty. The potential for a new refugee crisis could strain resources and political stability further.

- The US administration is balancing multiple international crises, including tensions in East Asia and ongoing support for Ukraine. A new conflict in the Middle East would complicate these efforts and strain military and diplomatic resources.